In recent years, Bitcoin has emerged as a popular digital currency that has revolutionized various aspects of the financial world. Its potential truly shines in the realm ofpeer-to-peer lending, enabling individuals to directly borrow and lend funds. without the need for intermediaries like banks. By leveraging Bitcoin’s decentralized nature and secure transactions, peer-to-peer lending has become more accessible, efficient, and transparent. process of using Bitcoin for peer-to-peer lending and highlight its benefits and considerations.

Understanding Peer-to-Peer Lending:

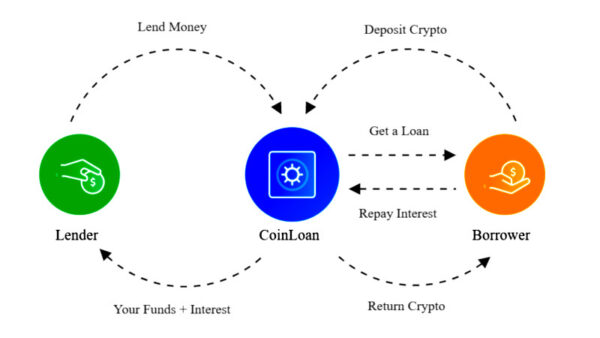

Peer-to-peer lending, also known as P2P lending or social lending, enables individuals to borrow and lend money directly without a traditional financial institution acting as an intermediary. This lending model cuts out the middleman, offering borrowers lower interest rates and allowing lenders Bitcoin adds an extra layer of convenience and security to this process.

Getting Started With Bitcoin For Peer-to-Peer Lending:

a. Acquiring Bitcoin

To participate in peer-to-peer lending using Bitcoin, the first step is to acquire Bitcoin. You can do this by purchasing Bitcoin on a cryptocurrency exchange or by accepting Bitcoin as payment for goods and services.

It’s important to choose a reputable exchange and follow proper security practices when setting up your Bitcoin wallet.

b. Choosing a Peer-to-Peer Lending Platform

Several platforms facilitate peer-to-peer lending with Bitcoin. It’s crucial to research and select a platform that aligns with your lending goals, offers a user-friendly interface, and has a robust reputation. Some popular platforms include Bitbond, BTCPOP, and BitLendingClub.

c. Creating an Account

Once you’ve chosen a platform, sign up and create an account. Provide the necessary information and complete any identity verification processes, as required. These steps may vary across platforms but are typically straightforward.

d. Depositing Bitcoin:

After setting up your account, deposit Bitcoin into your lending account. Follow the platform’s instructions to transfer Bitcoin from your personal wallet to the platform’s wallet. It’s essential to understand the platform’s security measures and keep your Bitcoin wallet secure.

Lending Bitcoin:

a. Review Borrower Listings

Peer-to-peer lending platforms allow borrowers to create loan listings that include details such as the loan amount, interest rate, purpose, and repayment terms. As a lender, carefully review these listings to assess the borrowers’ credibility and choose loans that align with your risk tolerance.

b. Diversify Your Investments

To mitigate risk, it’s advisable to diversify your lending portfolio by lending small amounts to multiple borrowers instead of investing a significant portion with a single borrower. Spreading your investments across various loans can help minimize the impact of a default.

c. Set Loan Terms

When lending Bitcoin, you have the flexibility to set your own loan terms. This includes determining the interest rate, loan duration, and repayment schedule. Consider market conditions, borrower risk, and your desired return on investment when setting these terms.

d. Monitor Loan Performance

It’s crucial to keep track of your lending activities and regularly monitor the performance of your loans. Peer-to-peer lending platforms often provide tools and notifications to assist lenders in managing their portfolios effectively.

Benefits And Considerations:

- Benefits Of Bitcoin For Peer-to-Peer Lending

Accessibility: Bitcoin enables global lending without the need for traditional banking infrastructure, making it accessible to people in underserved regions. This inclusivity promotes financial empowerment and economic growth.

Lower Fees: Compared to traditional lending institutions, Bitcoin-based peer-to-peer lending platforms often have lower fees, benefiting both lenders and borrowers. This cost advantage can lead toincreased profits for lenders and decreased borrowing expenses for borrowers.

Security: Bitcoin’s blockchain technology provides a secure and transparent platform for lending. Transactions are documented and authenticated, diminishing the potential for fraudulent activities and. improving trust between borrowers and lenders. The use of smart contracts ensures that loan terms are automatically enforced.

- Considerations:

Volatility: It’s important to consider Bitcoin’s value volatility when lending. Bitcoin values often exhibit significant fluctuations, indicating your investments can fluctuate significantly in value. Take this volatility into account when deciding how much Bitcoin to lend and diversify your investments accordingly.

Regulatory Landscape: Stay informed about the legal and regulatory framework surrounding Bitcoin and peer-to-peer lending in your jurisdiction. Regulations may vary across different countries, so it’s crucial to ensure compliance and protect your interests as a lender.

Conclusion

Bitcoin has opened up exciting possibilities for peer-to-peer lending, offering individuals an alternative to traditional banking systems. By utilizing the advantages of decentralization, enhanced security, and heightened transparency, Bitcoin-based peer-to-peer lending platforms enable borrowers and lenders to connect directly, creating a more efficient and accessible lending environment. However, as with any investment, it’s crucial to conduct thorough research, diversify your portfolio, and stay informed about the evolving regulatory landscape. By following these guidelines, you can navigate the world of Bitcoin peer-to-peer lending and potentially reap its benefits.

Disclaimer: Peer-to-peer lending and investing in Bitcoin involve risks, and it’s important to seek professional advice and do your own due diligence before making any financial decisions.

Read More on Backyard Pool Ideas On A Budget